Contents

TradeBrains portal helps traders in creating backtesting strategies and implementing them. The reports include metrics like portfolio growth, CAGR, absolute returns, YOY/MOM returns on portfolio stocks, and so on. Option backtesting is very similar to stock backtesting, except that it tests a chosen set of criteria for trading options. Like with stock backtesting, you also get detailed reports consisting of executed trades, drawdown, risk-reward ratio, compounded return, winning percentage, and more.

Wait for the news and monitor the upcoming financial events to see when a trend change can happen. Identify the assets that are possibly overbought or oversold. You can find a great article related to the news trading on our website. By evaluating emotions and fears of other investors, you can make a very good near-intuitive decision that can truly bring you a sizeable profit.

Habits of Highly Effective Traders

A lot is said about Backtesting of Strategies and a lot has been spoken as well about the same topic. The training workshops – paid as well as with no charge, all focus on this critical component of trading. Now I couldn’t cover all the aspects of backtesting in this video. There are a few things that we couldn’t cover here and there are all custom-defined input parameters that we can define on our own. The number 1 fault was with the number of profitable trades. Earlier we had barely 37% of profitable trades and now that number has significantly improved to 47% and that is a big win.

It’s not taught anywhere, it comes from experience. That to me is a problem because especially I like taking short trades and what does backtesting telling me? That is fault number 3 and we need to rectify this strategy. Now let us just understand this a little bit more. Out of the gross profit of almost 9 lakh rupees, we can see that almost 7 lakh rupees are contributed from the long trades and about 2 lakh rupees are contributed from them short trades.

Market sentiment should be used in the Forex trading for the currencies that are usually not that volatile and have the identifiable long-lasting trends. Those predictions are often wild guesses based on what an individual trader thinks about the community of investors in general. Understanding the nature of the market is the first step. Market sentiment is just a way to express how the investors behave at any given moment of time. Market sentiment can be used to evaluate future deals. The process involves several points that will lead you to a specific decision.

Forex Simulator – advanced manual strategy tester

When this metric goes up to 80%, traders assume that the market is overbought. This is why some experts say “fear sentiment” instead of the “market sentiment”. Investors are afraid to lose money when the market starts moving. Predicting when the movement starts and knowing its direction can give a trader that small edge to start selling or buying before others start doing it.

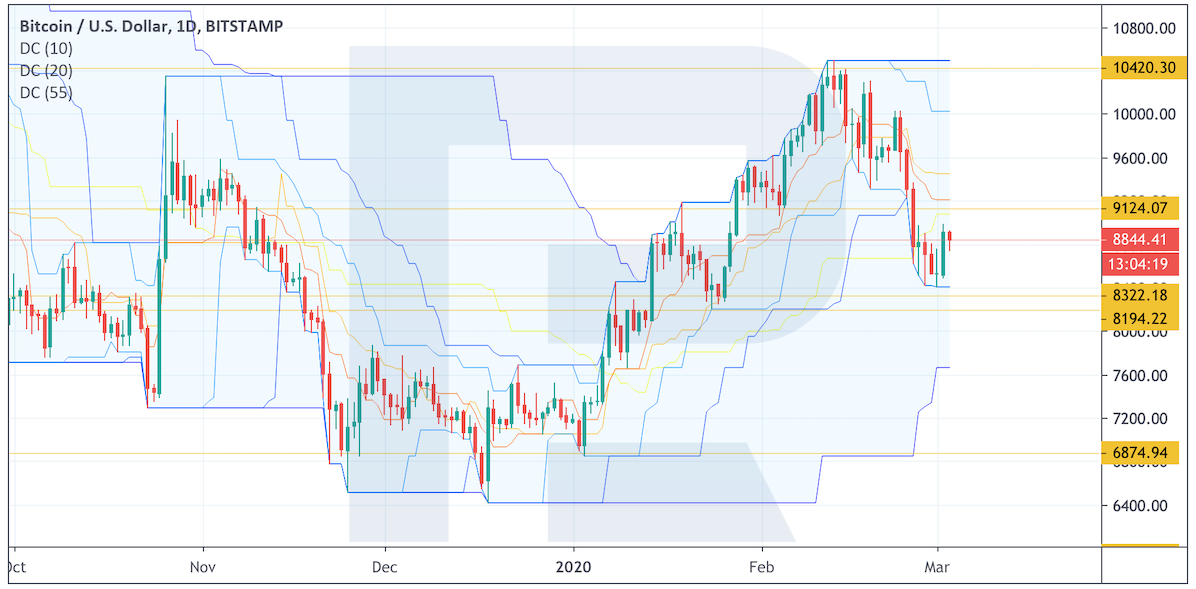

Forex trading is a domain that often creates great opportunities for the informed traders to make their moves be ahead of the competition and gain better profits. Let’s take the help of the same chart to understand how wicks can help a trader identify resistance levels. The central bank has maintained that allowing virtual currencies such as Bitcoins to foster poses financial stability risks. CBDCs, it said, will complement existing modes of payments.

Before trading view one of the biggest challenges that I had was finding a source where I can get clean historical data not just clean for the past six months or seven months. Going back let us say five years 10 years or 15 years. It’s very hard to find good clean reliable data from other sources. Forex historical data is a must for back testing and trading. Forex data can be compared to fuel and software that uses this data is like an engine.

Certificate of Completion

They usually use various methods to evaluate the market sentiment and apply fundamental and technical methods to predict where the market could go soon. Take a moment to observe the part of the chart encircled in blue. The candles marked 1, 2, 3, and 4 all have upper wicks. As with the previous example, these wicks are also price rejection points that signify the inability of the buyers to drive the price upward beyond a certain point. This point acts as the resistance level beyond which the price of the asset has refused to rise.

- Finally, you can analyze the result using various metrics in excel.

- Make your move quickly before other traders start acting in order to gain better profits.

- Charting, Portfolio Backtesting, Scanning of stocks, futures, mutual funds, forex .

- Also there are some unscrupulous brokers out there.

Should brokers offer an insufficient number of FX pairs to trade, this will limit a trader’s opportunities and strategy. We thoroughly test and evaluate all aspects of a broker. But our priority is to ensure that the trading costs advertised on the broker’s website are accurate. We also place special importance on reviewing a broker’s trading platforms, deposit and withdrawal fees, and withdrawal processing times. Brokers are always altering the products they offer, and we keep our reviews updated with the latest data available. Then you can find more details such as the number of winning trades, the number of losing trades, average winning trade and average losing trade.

Such that the implied cross-rate bid-ask quotations impose a discipline on the non-dollar market makers. If their direct quotes are not consistent with the cross exchange rates, a triangular arbitrage profit is possible. Swap transactions provides a means for the bank to mitigate the currency exposure in a forward trade. Such that a swap transaction is the continuous sale of spot foreign exchange Is eToro a Brokerage Firm That We Can Really Rely On against a forward purchase of an approximately equal amount of the foreign currency. In order to illustrate this, let us suppose a bank customer wants to buy dollars three months forward against British pound sterling. Now the bank can handle this trade for its customer and simultaneously neutralize the exchange rate risk in the trade by selling British pound sterling spot against dollars.

Real Time Doubt Solving

Ourbroker directoryincludes brokers that we do not recommend, but which remain an option for traders. Our directory is intended as a research tool for anyone seeking a professional ninjatrader broker opinion. If your current broker has not been evaluated by us, we hope that our selection of reviewed brokers will offer you a safer and superior alternative.

There are 5 groups in which the forex market participants can be categorized – 1. International banks – International banks provide the core of the FX market. Nearly 100 to 200 banks worldwide make a market in foreign exchange, such that they stand willing to buy or sell foreign currency for their own account. FX brokers – FX brokers match dealer orders to buy and sell currencies for a fee, but do not take a position themselves. Interbank traders use a broker primarily to disseminate as quickly as possible a currency quote to many other dealers.

Trading sentiment should be only a small fraction of a strategy when it comes to the Forex trading. In fact, most of the sentiment-oriented strategies often lead you to riskier decisions in comparison with more conservative approaches. RSI. Relative Strength openshift vs docker Index shows you whether the market is overbought or oversold. It is one of the simplest yet usable indicators available for traders. The complexity of this type of evaluation is what makes it difficult for the inexperienced traders to use this method.

Let us say for example you started with the capital of one lakh rupees and this is how your account has been growing. You went up to let us say 1.2 lakh rupees and then to 1.5 lakh rupees. Then you came down a little bit to incur my losses. You came down to 1.3 and then went up to 1.7 then 2. From 2 again you came back a little bit to 1.8 and then let us say you went all the way up to 3 lakh rupees.